Social Networking, Ipo | featured news

Zynga files for IPO of up to $1 billion

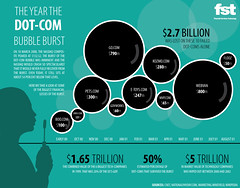

Senh: It seems like now's the time to do it while the market's still hot. Facebook is finally bleeding users, so social media is finally slowing down. These companies are still way over-priced when you compare each of their revenue with their valuation. I just hope the social media hype doesn't lead to another bubble. So far, it looks it will.

LinkedIn IPO skyrockets, trades as high as $92.99 a share

Senh: Which makes Linkedin worth about $8B, with annual revenue of $243M. That's about 30 times annual revenue. Hmm... The company still hasn't turned a profit.

LinkedIn looks to link up with investors with IPO

Senh: It'll be interesting to see how much Linkedin can raise. Facebook, at the moment, is way overvalued at $50B.